If you’ve started to look into organizing your finances, you’ve undoubtedly run across a multitude of apps designed to help you manage your money better. But are they really superior to simply firing up a few spreadsheets or writing down your expenses in a special journal?

Well, that partially depends on you! If you have needs that an app can fill and a personality that fits well with its approach, you’ll probably find that, with a little work, an app can have a positive impact. If, however, you’re not sure what you want out of the app and are just hoping it fixes your finances for you… well, you could probably benefit from putting in a little work on your own before downloading something.

What Do Personal Finance Apps Do?

There are lots of apps out there, but they can be divided into two main categories:

- Budgeting/tracking apps

- Saving/Investing apps

Budgeting apps typically do a few main things:

- Help you make a budget

- Consolidate and sync your financial account information

- Automatically (or manually) track your spending

- Give you alerts related to your bills, transactions, or budget events

Depending on the focus of the financial app, it might also help you make a budget, identify wasteful spending, aid you in setting a goal, build spending habits, provide learning materials, and give relevant financial advice. The core features are generally quite similar, but some apps are stronger at certain things. Knowing what you need will help you know which apps could specifically work for you.

Saving and investing apps might also come with some budgeting features, but what they really specialize in is directly managing your money and helping you make a plan for your future. Some examples of things they might do include:

- Helping you choose investments

- Automatically saving or investing for you

- Financial planning/projecting your future net worth

- Nudging you to save more

They’re typically quite easy to get started with, but keep in mind that these apps are still using your actual money and there can be risk involved! They are, however, quite a user-friendly way to get started on saving and investing.

Not sure which type you need? Well, you may want to consider both! They can complement each other quite well. Budgeting apps can help you free up money to put aside for your goals, and saving and investing apps can ensure that your money grows effectively—and some even combine both functions.

What Are You Trying to Do?

The first step in finding an app to help you reach your financial goals is, of course, figuring out what those goals are and what you need to reach them! Once you have that figured out, you’ll be able to sus out whether or not an app would actually be helpful for you.

Setting goals is a topic all unto itself, but, at a minimum, you should try to list:

- A specific description of the goal

- How much the goal will cost you

- When you want to achieve the goal

- Why this goal is important to you

Next, you should take rough stock of your financial situation. Are you already fairly organized? Do you have savings already set up? Do you have any form of budget? Or are you behind on savings with no budget and no idea where to start? Whichever part of the spectrum you’re on, you should identify specifically which areas you need help with:

- Spending control

- Help saving

- Monitoring your money

- Financial planning

- Learning more about finance

Spending control, saving, and monitoring are areas that apps are well-suited for. They’re very good at taking input and returning useful output as long as those are the main things that matter. It can, for example, look at a list of your transactions and identify potentially useless subscriptions and areas of high spending. Or it can take your money and automatically invest it in a way that will probably provide good returns.

If you need help with financial planning or learning, though, you’ll either have to look for an app that specifically focuses on this or investigate alternative resources. For financial planning, advances in AI are making software more personally useful all the time, but they’re only as good as the data they have, and your situation may be more complicated than an app can usefully process.

When it comes to learning, there are certainly apps that help guide you towards smart decisions, but only a few of them make a point of actively teaching you the concepts behind personal finance.

Pros and Cons of Personal Finance Apps

Most people probably will benefit from using an app to manage their finances, but it’s important to know the limitations and downsides as well! So, what are the ups and downs you might encounter?

Pros

- Convenience. Apps that automatically track your finance save you from manually recording transactions and they make keeping tabs on your money as easy as checking your texts.

- Insights. Analyzing your spending trends, identifying waste, getting a comprehensive view of your saving habits… that would take a while to do in a spreadsheet, but many apps just give you that info on a dashboard!

- Helps you save. Budgeting apps can help you control your spending better and saving apps can help you put away money more effectively.

- Alerts. Do you sometimes forget to pay a bill? Forget to put money in savings? Want to know when your credit card is being used? Apps can remind you!

- Low barriers to entry: Most apps are low-cost or have free versions with basic functionality, and they’re carefully designed to be easy to set up and use. Setting up an app to help you with your money can take minutes—though to get the most out of it you’ll probably want to take the time to connect all your accounts and learn about the features.

Cons

- Not magic: Finance apps aren’t going to magically turn your life around, but they can make you feel as if you’re doing something when, really, you’ve just set up an app and aren’t making meaningful changes. Manually budgeting is hard, but it does put you in the mindset that you need to put work into your finances, while apps can potentially create more distance between you and your money.

- Notification overload: Finance apps that constantly send you notifications and reminders can end up inspiring you to ignore them rather than act on them. Swiping away a notification is way easier than finding room in your budget! Make sure you don’t get inundated with messages and develop a habit of acting on them.

- Not comprehensive: Your finances, goals, and personal situation are more complex than an app can hope to grasp. AI is getting better, but it’s still only as good as the data it gets, and you’ll probably have to take the time to adapt its advice to work with your own situation.

- Risk: Apps that invest money for you don’t necessarily protect you from losses! No matter how user-friendly the investment firm’s app is, it’s still just a layer between you and the market, and if the market goes down, so does your balance. There’s also some level of privacy/security risk in giving your financial data to a third party, but we’ll discuss that next!

Are Personal Finance Apps Safe?

In a word, yes—most of the popular personal finance apps are safe to use. Having a data breach would be very bad for their business, especially if they’re run by a larger financial institution, so they secure your data as well as anyone can. That said, however, nothing is completely safe, and the more apps you give your data to, the greater the risk that one of them will turn out to have a vulnerability.

If you’re using a budgeting app that connects with your external bank accounts, you don’t need to worry much about your money. These apps typically do not have permission to do anything but look at your accounts, so they won’t be moving your money anywhere.

If the app can transfer money, though, you’ll want to make sure you know the risks and whether the app has insurance that will cover your losses since banks might not be liable for money that is stolen via a third-party app breach.

However, given the security used by these apps, the thing you have to worry about is actually not the entire app getting hacked—it’s you, personally, getting hacked!

You can protect yourself by practicing good security hygiene—don’t reuse passwords, double-check links you click on, and enable two-factor authentication (2FA) for your sensitive apps.

So, Should I Use an App?

Before you start choosing an app, ask yourself these questions:

- Do I know what my goals are?

- Do I know what I need to do to reach them?

- Do I hope the app will solve my financial problems for me?

- How have my past attempts at managing my finances gone?

Ideally, your answers will be:

- Yes, and I have them all listed!

- Yes, and I’m making a plan!

- No—I hope it will help me solve my problems on my own.

For the fourth question, the answer you really don’t want is “I try something new for a few days and then give up.” If you haven’t been able to make other changes stick, an app might help—but only if you combine it with a real plan to maximize your follow-through.

If your goal is to get out of debt, save for something specific, or make a comprehensive financial plan, you should ask yourself what specifically you want the app to do for you and what you’ll handle on your end.

On the other hand, let’s say you have your goals generally handled already and are just looking to try something to help you save more or get a better look at your money, an app can be a great idea to set up in your spare time. Almost everyone can benefit from saving more or seeing what their money is doing, and tons of apps can help with that—just remember that they’re tools, not genies!

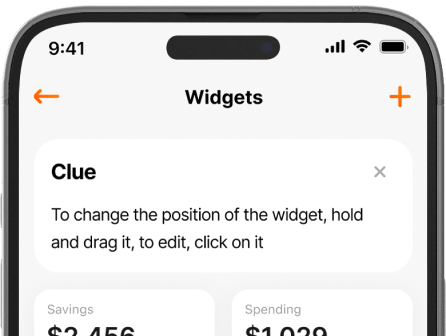

And one of such tools is Finmatex app. It will help you get your finances under control, set goals and track your progress, create and stick to a budget, and more. Download it on Google Play or App Store and give it a whirl for free — we offer a 1-week trial period.