The term “good debt” might seem a little strange at first glance. Ideally, you’d have all the money you need and not owe anything to anyone, right? The reality, though, is that most of us don’t have all the money we need, and sometimes going into debt is the right decision for your future. A university education, for example, can increase your future earning potential, but not many people have the cash to pay for it. A student loan, then, could be classified as “good debt”, since it can pay off in terms of employment opportunities, social networks, and self-improvement.

The existence of good debt also implies the existence of bad, though—and it turns out that bad debt is a lot easier to fall into. Any debt that doesn’t positively impact your future belongs in this category. That includes most material purchases and most loans with high interest rates, like credit cards or personal loans.

So, when is taking on debt all right, and when should you avoid it? There are three basic principles we’ll discuss here:

- Consider taking on debt if it’s an investment that will improve your future life

- Consider taking on new debt if it helps you manage old debt

- In general, try to avoid all debt that trades short-term payoffs for long-term payments

Investing In Your Future

Yes, getting the latest iPhone might improve your enjoyment of technology, but unless you specifically need such an expensive phone to work, study, or survive, it’s almost certainly not worth going into debt for. You should always look at debt in terms of an investment. A good investment has an upfront cost but ends up yielding a profit later on.

For example, taking out a $10,000 loan with a 5% annual interest rate will cost you about $1,300 if you pay it off over five years, plus it’ll lower your future disposable income by about $190 per month. Will that loan enable you to either make or save at least $1,300 more than you otherwise would have? If so, it’s a good investment.

So, how can you use good debt to invest in your future?

Education

If sheer numbers are anything to go by, university education is one of the best investments out there! 43.2 million Americans have student loans as of November 2021, translating to 1.75 trillion dollars of overall debt. That exceeds credit card debt and is second only to mortgages!

On average, each student borrower is $36,900 in debt at graduation (as of August 2021) and has a total repayment of $40,158, so the question you may want to ask here is “will this education result in me earning at least $40,158 more over my career?

While earnings can vary substantially based on background, gender, field of study, location, etc., the median lifetime earnings of college graduates are anywhere from $450,000 to $900,000 more than the median lifetime earnings of high school graduates, even controlling for other factors.

So, are student loans a no-brainer? Not exactly! If you go to school for metalsmithing (not exactly an in-demand skill anymore) you’ll probably make a lot less than if you skipped university and taught yourself computer programming. Yes, there’s more to education and life than money, but if you’re doing the math the way you would for other investments, you should be aware that some student loans will end up yielding higher returns than others.

Of course, education isn’t limited to only university—you might want to borrow money to enroll in training courses, bootcamps, get certifications, etc. The only rule here is that you should be at least reasonably certain that your education will pay off down the road!

Starting a Business/Getting a Small Business Loan

The entire point of a business is to make money, so it definitely qualifies as good debt—assuming you have a reasonable business, a well-thought-out plan, and the follow-through to make it successful. A lot of this being “good debt” hinges on the business not failing, though! If your business ends up bringing in less than you need to cover payments and your own expenses, you might end up missing payments or defaulting on the loan. If that happens, the bank can take whatever you put up as collateral—including your own personal funds, if you personally guaranteed the loan.

According to the Bureau of Labor Statistics, about 50% of businesses will fail within 5 years, so you should be well aware of the challenges you’ll face before you borrow money. Starting a business can be freeing, fulfilling, and profitable, but going into debt over it is the opposite of all those things. If you start small, stay organized, consistently improve, and aren’t afraid of getting creative, your odds of survival will go up, so if you think you can make it happen, do your best!

One thing to be aware of is that many small business loans require 1-2 years of operation and some level of minimum annual revenue to qualify for. Thus, if you’re just starting a business, you may not be able to get a small business loan—you’ll have to use a personal loan, business credit card, or other financing option to get off the ground if you can’t self-finance. These take you significantly closer to “bad debt” territory, so be sure you have a plan to pay off that high-interest debt as quickly as possible.

Buying a Home

Mortgages are the most common type of good debt, with about 70% of US household debt sitting in them, and are considered safe because the home will likely increase in value, given enough time. Add to this that mortgage interest rates are relatively low and homeowners get some tax benefits, and you can be reasonably certain that the interest you pay on the loan will be less than the returns you’ll get. You could even start making money on a mortgage right away by renting out the property, turning your investment into an income generator that will, hopefully, cover the mortgage and then some.

That said, buying a home isn’t necessarily for everyone. There can be a lot of upfront costs, maintenance expenses, tax liabilities, insurance, etc. It’s a big financial decision, and one you want to approach with careful planning and budgeting. If you want your investment to appreciate well, you’ll have to do your research and be sure you’re getting a good deal. And, of course, if you have bad debt piling up, you may want to put off buying a home until you’ve taken care of it.

Managing Old Debt

The second major way that debt can benefit you is if you already have debt and could potentially make it less of a burden by replacing it with other debt. The two main ways to do that are listed below!

Personal Loans

Wait, aren’t personal loans in the “bad debt” category? Well, it depends on what you use them for. Personal loan for a new jet ski? Bad debt. Personal loan to help you pay off other, higher-interest loans? Good debt!

Debt consolidation is one of the best uses for a personal loan, since it can lower the amount you end up owing in interest. Here’s how it works:

- You have high-interest debt, like credit card bills, that you need to pay off over time—say, a year.

- Your credit cards charge 18-22% interest per year, which is quite high.

- You find that you’re eligible to get a personal loan at 12% per year.

- You borrow the money you need to pay off your credit cards and then start making only the loan payments, saving you 6-10% in interest per year!

This counts as good debt because it’s improving your future financial situation. Loans for home improvement or something else that contributes to the value of an asset you own can also be good, though be sure you’re getting your money’s worth!

Balance Transfer Credit Card

On a similar note, if you have a lot of credit card debt and want to reduce your interest payments, some credit cards specifically allow you to transfer balances from your other cards and pay 0% or low interest for an introductory period! This is still “bad debt”, but the lower interest payments make it a good choice if you’re already in debt.

Necessary Debt

Sometimes you don’t have a choice—you need to go into debt. A common scenario here would be medical bills—being healthy and alive will pay off in the future, since you’ll be able to work, make money, and enjoy your life more than if you didn’t get your problems taken care of. While there are ways to minimize medical debt, going into it when you need to is probably the right decision.

The same can apply to any other debt you go into because it’s essential. “Essential” covers anything that endangers the life, health, or future earning ability of you or your family. Need a car to get to work? That could be a good reason to go into debt. Need to fix your heat in the winter? Also debt-worthy.

Ideally, however, you should be able to cover these expenses with an emergency fund. If you don’t have one, it’s never too late to start building it!

Staying Out of Bad Debt

The rule for staying out of bad debt is simple: if it’s not good debt, don’t do it! As we discussed above, good debt will pay off more in the future than it ends up costing you—the saying “it takes money to make money” is a good way to remember how good debt works! If the debt isn’t likely to turn a profit, it’s probably bad debt.

This includes things like:

- Credit cards (if you don’t pay them off)

- Auto loans (unless you need the car and can’t pay cash)

- Personal Loans (Unless they’re going to be a net gain financially)

- Payday loans

- Any other high-interest loans

Debt Can Be Constructive!

Debt is a financial tool and it does belong in your toolbox. If you limit yourself to only what you have the cash for, you can find yourself missing out on more money down the road. Of course, you have to be smart about your debt—taking out student loans for a low-paying degree that you won’t finish would become bad debt. Additionally, even good debt can go bad if you can’t pay, so make sure you can afford the loan payments before you commit to it.

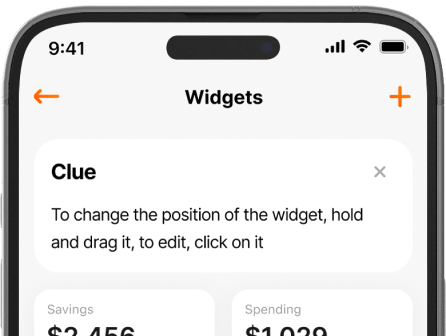

And if you have a hard time taking your finances under control, check out Finmatex app for convenient money management. It’ll bring all your accounts in one place, categorize your expenses, track your goals, and much more. Download it on Google Play and App Store and start your free 1-week trial period.