We’ve already covered what financial life is and have broken down the concept of 4D Financial Life. In this article, we’re going to discuss how to set financial goals the smart way.

How Do We Usually Set Goals?

All goals start with dreams which we make a reality. As soon as you articulate a dream more clearly, and imagine it in detail, a dream becomes a goal.

If a goal is big and seems impossible to reach, you need to break it down into steps, each of which should be an achievable goal itself.

Once a goal is clearly defined, it’s time to outline a plan to accomplish it and track our progress.

This is a common intuitive approach to setting and achieving goals, but there are many other more effective techniques. And one of them is called SMART.

How to Set SMART Goals

Setting personal and professional goals determines your life and your development. But it’s not enough just to articulate goals — you need to set them correctly so that you feel motivated and excited to achieve them. To do so, you can use the SMART method of setting goals:

- S – Specific

- M – Measurable

- A – Achievable

- R – Relevant

- T – Time-bound

Specific

Your goal should be specific, i.e. described in as much detail as possible. “I want a new car” is not specific enough. The correct way to set a goal would be, “I want to buy a white Mercedes E-Class, 200-240 hp”. The more specific, the better.

Measurable

Your goal should be measurable. You need to ask yourself, “What will it cost me to achieve this goal? How can I measure the result?” Answer honestly and clearly. For example, “I plan to buy a white Mercedes E-Class, 200-240 hp for $60,000. I will need to pay an additional $36,000 after I sell my car.”

Achievable

Your goal should be achievable. Ask yourself, “Is this goal within my reach? Can I save $36,000?” If the answer is no, then you need to figure out if you can make more money and come up with a way to do so.

It’s important to understand that unattainable goals can demotivate you. Therefore, before setting a goal answer honestly to the question, “Can I really achieve this?”

As we’ve already mentioned, each big goal can be broken down into smaller steps. If you do so, you can assess each next step in terms of achievability.

When deciding between setting a big material goal, for example, “I want to buy a car”, and a smaller one that won’t require much effort, focus on the priority of the goal. It will help you make the right decision.

If you set personal development goals such as, “I want to grow professionally/increase my income/learn new things/do sports”, always set goals that will require effort from you but also will be possible for you to achieve.

Relevant

Your goal should fit your current life situation and be really valuable to you. You’ll probably even have to sacrifice something to achieve it, for example, to cut expenses or to work more. Therefore, it’s important to ask yourself, “Am I ready to make these sacrifices? Are they worth the value I’ll get? Should I go for it?”

If your goal is to buy a Mercedes E-Class, you need to answer these questions, “Why do I want to get a Mercedes and an E- class, and not a cheaper, or vice versa, a more expensive car? What value will it add to my life? Why is it important? How will it affect my budget or other material goals? Am I ready for this change?”

Time-bound

All your goals should have a specific deadline. When it comes to big goals with many steps, each step should have a specific deadline, especially each next one. Setting a deadline will help you decide when exactly you want to achieve your goal.

So, according to the SMART technique, the Mercedes goal should look like this:

“In three years, I’m planning to get a white Mercedes E-class, 200-240 hp for $60,000. I will have to pay an additional $36,000 after I sell my car. That’s why I need to save $12,000 a year or $1,000 a month for three years. I can afford it and it won’t affect my budget or my other goals.”

Short-, Medium-, and Long-Term Goals

As we’ve already mentioned, every goal has a deadline. Depending on their deadline, there are three types of goals:

- Short-term goals,

- Medium-term goals,

- Long-term goals.

Short-Term Goals

These can include goals that take less than a year to achieve:

- To take a trip,

- To take a course,

- To buy a new laptop.

Medium-Term Goals

This group consists of goals that take several years to accomplish. For example:

- To buy a car,

- To take an expensive round-the-world cruise,

- To pay off a student loan.

Long-Term Goals

These goals take over 10 years to reach. Some examples of such goals would be:

- To save for retirement,

- To pay off a loan,

- To save for kids’ education.

Why classify our material goals according to timelines for achievement in the first place? The thing is, the more time it takes to achieve a goal, the more expensive it is. Therefore, goals with different terms will require you to use different strategies for managing them and different tools for financing them. We’ll cover it later in more detail.

How to Prioritize Goals?

You can have many different goals, but the question is how to accomplish them all. That’s why SMART has the letter R, which stands for “relevant”. This criterion helps us understand which goals are relevant or important to us and which are not. Based on their relevance, there are three groups of goals:

- High-priority goals,

- Medium-priority goals,

- Low-priority goals.

High-Priority Goals

This group can include goals that have a strong impact on your life and its safety. For example:

- To start an emergency fund,

- To buy a new car you can’t do without because you live out of town,

- To set up a 401k,

- To save for your kids’ education.

Medium-Priority Goals

These can include goals that are important to you or give you a lot of pleasure, but do not affect your safety. For example:

- To invest in your hobbies,

- To buy a house,

- To renovate your home

- To get promoted.

There are goals that may fall into either the high-priority or medium-priority category. It depends on how you personally perceive these goals. For example, buying a house might be in the medium-priority group if you are okay with living in a rented house or apartment. But if your motto is “My home is my fortress,” and you feel that not having your own home affects your security, then buying a house will be a high-priority goal for you. The same goes for career or business goals. For some people, a job is just a source of income, and building a career is not important to them. While for others their job brings a feeling of safety and security.

Low-Priority Goals

This group includes all goals that do not fall into the previous two categories. These are goals that you would like to achieve, but if you don’t, it won’t affect your safety and happiness.

Your Goals Are Flexible

Your goals, both material and non-material ones, are flexible. They change as you, your views, and your priorities in your personal and professional life change.

To Sum Up

- Use the SMART approach to setting goals.

- Divide goals into short-, medium-, and long-term ones.

- Prioritize your goals.

- Adjust your goals over time.

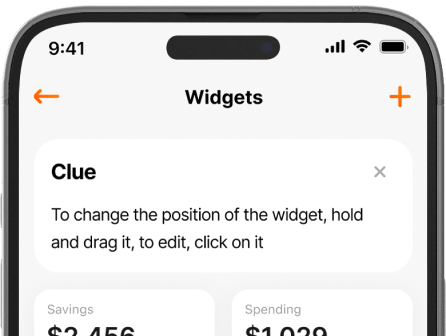

And if you want to jump from theory straight to practice and start setting smart goals — try Finmatex. It’s a personal finance management app that will keep your motivated and encouraged on your way to making your financial dreams a reality. Go on Google Play or App Store, click ‘download’ and start a 7-day free trial now!