Let us imagine the life of a being in the first dimension. It can be a point that can only move within a line to the right or to the left. In the second dimension, it can be a flat man moving across a large sheet of paper. We live in the third dimension. There’s the fourth dimension — time. We know it exists, but we can’t move in it. To sum up, we could say that we live in a world of four dimensions, one of which is not tangible to us. So what about our financial life?

As we mentioned in the previous article, financial life is one of the parts of your life. But how simple or complex is it? Most resources tend to focus on only one aspect, say, budgeting, and claim that managing your finances is easy if you know how to budget. Others zero in on paying off debt, ignoring that debt is usually the source of funding personal life goals. Others again tell how to create investment portfolios and trade in the stock market. The truth is, they only teach how to figure out only one aspect of your financial life. However, all aspects of financial life should work in concert and align with your personal and professional life. And your character, outlook, and habits impact them too.

Financial life has four dimensions:

- Budgeting;

- Debt;

- Insurance;

- Investment.

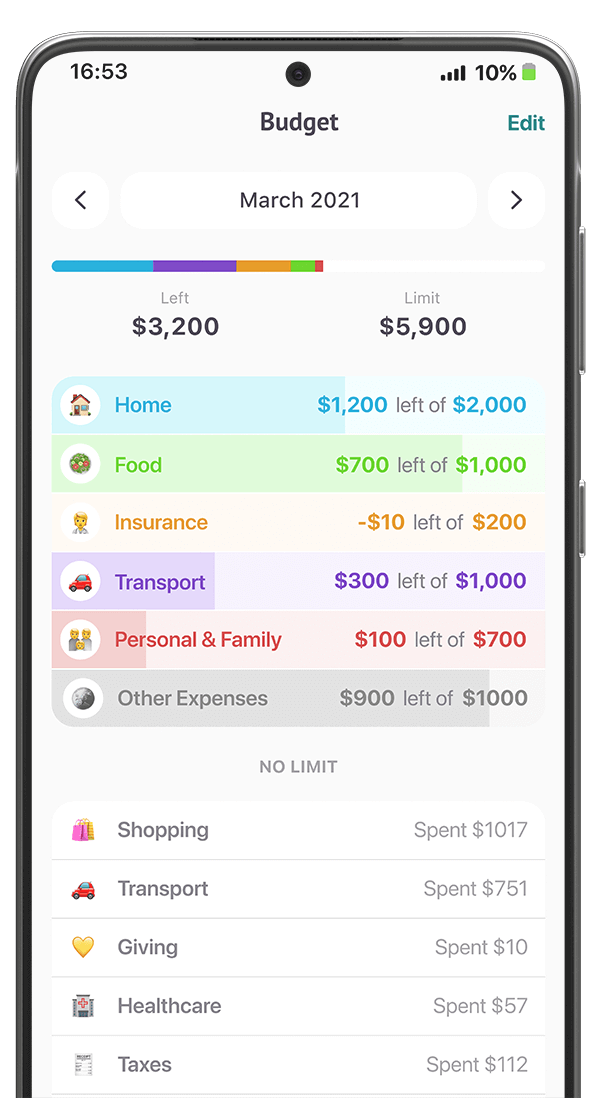

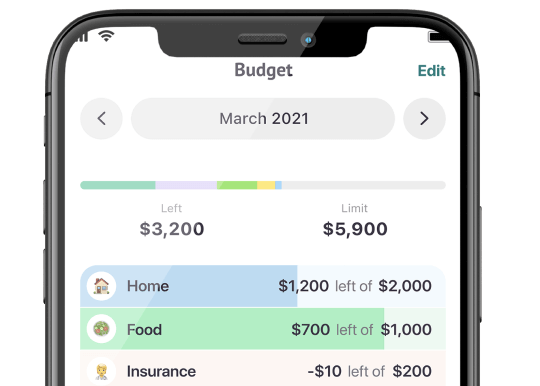

Budgeting

The first and most important dimension of your financial life is budgeting. A well-planned budget is like a tailwind for a sailboat — you can’t start moving in the right direction without it. The basic rules in this dimension are:

- Create a budget;

- Manage and adjust your budget;

- Save at least 20% of your income;

- Increase your expenses by no more than 50% of your income growth.

This is the most important part of your financial life, its basis. 90% of your success in budgeting comes from self-discipline and the right financial habits. That’s why many people fail to build a healthy financial life. They can’t keep themselves under control.

When you take control of the first dimension, you will learn how to finance your material goals consistently. You will learn to plan expenses and avoid impulse purchases. You will build a relationship between your financial life and your personal and professional lives, and start sending clear signals to your professional life that you need to increase your income. And then your financial life will begin to improve rapidly.

Debt

The second dimension you should learn to manage is debt.

Debt is the easiest and yet the most dangerous source of funding for your goals. It’s important for you to understand when to use it and when not to. By taking out a loan you can accelerate your material goals, but you can also ruin your financial life. The basic rules you should adhere to are:

- Create a debt plan;

- Monitor and improve your credit score;

- Avoid high-interest loans;

- Reduce your debt servicing costs.

In this dimension, you should learn to prioritize your material goals and realistically assess your financial ability to pay your debts.

Once you learn to manage the second dimension, you will improve your relationship with the first dimension, your financial life will become more stable, and life, in general, will become more peaceful and financially healthy.

Basically, to live a peaceful and happy life, it would be enough to learn how to manage these two dimensions if it were not for emergency situations and inflation.

Insurance

The third dimension is insurance.

Insurance is your peace of mind in case of emergencies. To ensure they do not derail your financial life, you need to figure out financing for illness and emergencies. The basic rules to follow in this dimension are:

- Build an emergency fund;

- Get life insurance;

- Use health insurance;

- Get personal property insurance.

Insurance is a dimension that is pretty easy to manage. However, it will make your financial life more predictable and stable. This is your safety net for emergencies.

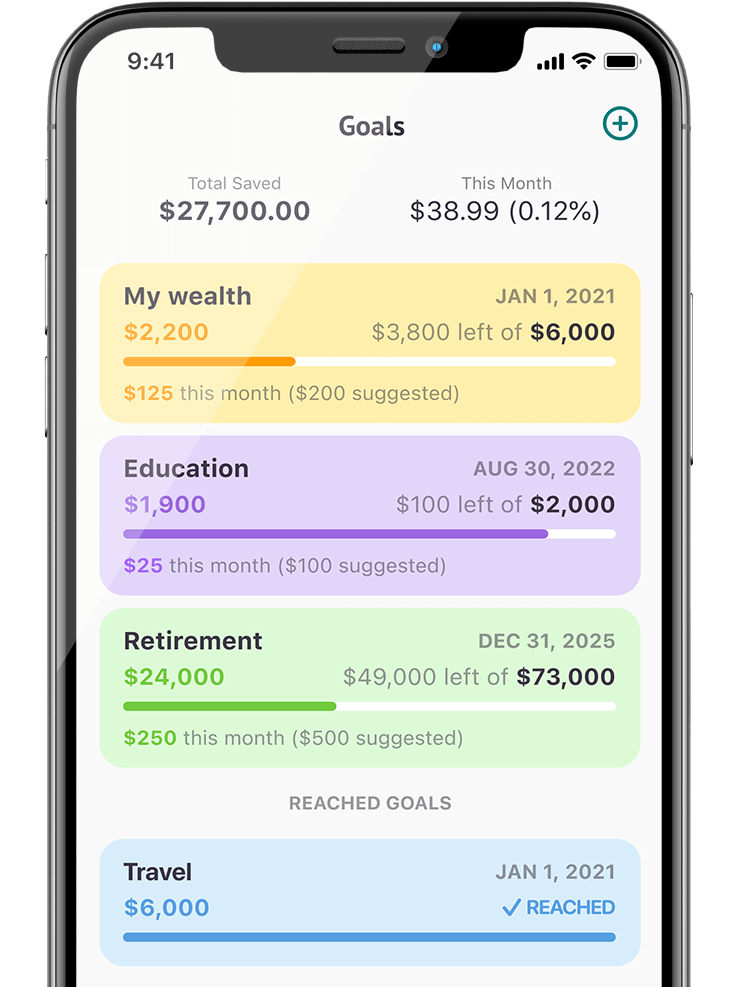

Investment

The fourth dimension is investing.

As soon as you save some money, you will immediately face inflation. It will devalue your money. It won’t affect one- or two-year goals significantly. But your savings for long-term goals of 10-20 years will lose a significant amount of purchasing power. Such goals are the reason your financial life has a fourth dimension. The basic rules of this dimension are:

- Make your money work for you;

- Understand and control risks;

- Don’t put all your eggs in one basket;

- Focus on low-cost investments.

Once you learn to control the fourth dimension, you make the banks’ most powerful tool — compound interest — work for you. You will be able to outpace inflation and create passive income.

You should know, though, that this is the most difficult dimension of your financial life because it’s the most unpredictable one. Just like we can’t see 4D objects — only their 3D slices — we can’t predict whether our investments will be successful! We can only know the current value of our assets, control our portfolio risk, and assess our chances.

What is 4D Financial Life

We combined all four dimensions into a single concept — 4D Financial Life. It will help you understand and manage your financial life and its main components, figure out how it’s connected with other sides of your life, and enable you to develop the right financial habits.

What is 4D Financial Life? Let’s compare it to health. If you are in pain, you go to the doctor. If you want to stay healthy, strong, and energetic, you start a healthy lifestyle. You eat healthy food, work out, and follow your daily routine. The same goes for financial life. If you have money problems, you should see a financial consultant who will solve your problem. And if you want to lead a healthy financial life, you need to start a healthy financial lifestyle. And 4D Financial Life is a method of leading a healthy financial life.

Changing money habits and starting a new financial lifestyle is way easier with a reliable partner. We recommend that you try Finmatex — your personal money assistant that will help you stay on track with your expenses, enable you to spend less and save more, and support you on the way to your goals. Download it on Google Play or App Store right now and start a 7-day trial free of charge!