So, you went to college, probably got a degree, and felt like everything was going pretty well… until you remembered that you now have more debt than money. 45.3 million Americans have student loans, weighing in at a hefty 1.71 trillion dollars of total debt—more than credit cards and only less than mortgages! The average borrower owes $37,691, but whether you owe more than that or less, you’ll need a solid repayment strategy to help you minimize your debt burden.

Types of Loans

42.9 million Americans have federal student loans, while only 2.4 million have private loans. That number in itself should probably tell you something: federal loans are generally a better idea. They come with more payment plans and protections and generally have lower interest rates than private loans. If you’re not sure which type you have, chances are they’re federal, which means you have more flexibility.

These differences may not seem hugely important when you’re applying for loans, but they’ll definitely affect how you repay them. Federal loans offer things like income-driven repayment plans and loan forgiveness, while private loans tend not to have a lot of options.

If you have both, you’ll generally want to pay your private loans first so you can take advantage of the greater flexibility offered by federal loans.

Getting a Handle on Your Loans

It might sound strange not to know what or where your loans are, but they can be confusing, especially when you’re busy with university and possibly not so experienced with finances. Luckily, there are some easy ways to figure out vital information about your student loans.

- Find your loans

The National Student Loan Data System (NSLDS) makes hunting down your federal loans pretty easy. Once enrolled, you should be able to see all your information collected in one place.

Private loans have to be managed through your private loan servicer(s), though, and can’t all be seen in one place. If you’re not sure where they are, the easiest way to find them is probably via your credit report. You can get these from a lot of different places, but a good place to start is annualcreditreport.com, where you can learn how to get reports for free.

- Figure out your total debt

Some simple addition is all you need here: if you have multiple loans, just add up the balances and get a rough idea of how much you need to pay.

- Identify your interest rates

You’ll generally want to pay the loans with the highest interest rates first, so as to minimize how much you’ll eventually owe. You should be able to see your loans’ interest rates by checking with your servicer.

- Learn your loans’ repayment rules

Dealing with different loan terms can be a complex issue. Consolidating or refinancing your loans can make your life simpler, but you’ll still have to be aware of what you’ve gotten into. Check for:

- Your payment plan options

- Your grace period (if you still are or just finished studying)

- Your deferment/forbearance options

Make it Simpler! Consolidate or Refinance Your Loans

Handling one monthly payment is a lot easier than handling four or five, plus, consolidating or refinancing your loans can potentially get you better terms than you currently have. This can be useful no matter what stage of repayment you’re at!

Consolidating Federal Loans

If you currently have several different types of federal loans with different services, combining them into a single Direct Consolidation Loan can be a great strategy for simplifying your terms and payments. You’ll get a new interest rate that is the average of your existing loans’ interest rates (rounded up to the nearest 1/8 of 1%), potentially up to 30 years to get out of your debt (which lowers your monthly payment), and access to income-driven repayment plans and Public Service Loan Forgiveness if your existing loans don’t come with those things.

However, it’s not all a win. If you’re currently using or working towards benefits with one of your existing loans and those benefits would be canceled out by switching, you might not want to consolidate.

Private loans typically can’t be consolidated in this way—you’ll have to look into refinancing for that.

Refinancing Loans

Refinancing means getting a single new private loan to pay off multiple existing loans. It’s most useful when you have several different private student loans and want to simplify your payments. If your credit has improved since you first took out the loans, you may be able to get a lower interest rate on your new loan, but it’s probably not the best idea to refinance if your interest rate would be higher than the average of your current loans.

You can also choose to refinance your federal loans with a new private loan, but this may not be the best strategy if you want to use the payment plans and perks that come with them.

Repayment Plans

Federal Repayment Plans

One of the big perks of having federal loans is all the options you have for paying them back! If you have a Federal Direct loan or a Direct Consolidation Loan, you’ll qualify for all of these. If you have a different type of federal loan, you may have some of these options but not others. The standard repayment plan is ten years, but you can get up to 30 years with consolidation loans.

- Standard Repayment

You’ll pay your loan off over 10 years with fixed monthly payments. This is the simplest type, and because you don’t start off with lower payments, you’ll pay less interest in the long run.

- Graduated Repayment

Your payments start low but increase every two years or so. This helps if you’re not earning much right after graduating, but you will pay more interest in the long run since your balance will be higher for longer.

- Extended Repayment

If you want lower monthly payments, you may be able to get up to 25 years to pay off your loan with this plan. Your interest payments will be higher, but the lower monthly payment may work better for you.

- Income-driven Repayment

There are actually four types of income-driven repayment plans, and they’re all slightly different. They all share two common characteristics though:

- You pay 10-20% of your discretionary income, recalculated each year

- You pay for 20-25 years, after which any remaining balance is forgiven

All of these loans will probably result in you paying more in interest than you would if you had a standard plan, but can be a great choice if you’re looking to get your loans forgiven eventually. Some of the plans, like Pay as You Earn (PAYE) require financial hardship to qualify, but you’ll probably be able to get at least one of these plans if it sounds like something you want.

Which Plan is Best?

If you can keep up with payments, a standard repayment plan will cost you the least in interest payments. Otherwise, the plan you choose depends on your circumstances. Looking for loan forgiveness? Try an income-driven option. Career starting slowly? Maybe try a graduated repayment plan. Choosing the right plan can make your life easier, but remember that with federal loans, you can always change it later on if you need to, so don’t feel too much pressure to decide on a plan right out of the gate.

Loan Forgiveness

Certain payment plans will allow your loan to be forgiven after about 20 years of making consistent payments, but there are ways to get your student loans forgiven completely.

Public Service Loan Forgiveness (PSLF) is a program that offers loan forgiveness in return for working in a certain job and making payments for at least ten years. These jobs are usually non-profit/government professions with lower pay, such as firefighting, teaching, military service, etc., and may be located in areas that have a shortage of qualified workers. Volunteering at certain organizations can also count. PSLF can be tricky to apply for and get, though, and come with a lot of conditions. Be sure you know what you’re doing if you go down this route!

Other forgiveness opportunities also exist, such as the Teacher Loan Forgiveness Program, so if you think you have a career that might qualify you, look into your options!

Private Repayment Plans

If you have private student loans, you won’t be eligible for any of the income-driven options mentioned above, but they often have options that can reduce payments temporarily if necessary. The only flexibility you typically have with private loans is deciding what to pay while you’re still in school—nothing, interest-only, low payments, or full payments. Different lenders have different options, though, so you’ll need to check yours.

Handling Payment Issues and Temporary Setbacks

If you’re having trouble paying off your loans, you may be able to get them put on hold for a while. This is generally done through either deferment or forbearance. Federal student loans come with both options, but private loans may come with both, just one, or neither.

Deferment

A deferred loan is typically contingent on you being in school at least half-time, unemployed, in financial difficulty, or satisfying some other condition. You won’t have to make payments for the deferment period, and certain loans will also suspend interest payments.

Forbearance

Forbearance doesn’t require the qualifying conditions that deferment does, but your loans will continue to accumulate interest, which is the disadvantage.

General Payment Strategies

If you’re getting serious about paying off your loans, there are a few things you can do to help make the process as painless as possible!

- Deduct student loan interest from your taxes. You can write off up to $2,500 of interest accumulated on both public and private loans, so it’s worth doing!

- Set up auto-pay. Not only does this make it more likely that you’ll pay on time and avoid late fees, but if you auto-pay federal loans you’ll get a 0.25% interest rate deduction, which can be worth thousands of dollars over time. Some private loans also give you benefits for using autopay.

- Pay off your credit cards, auto loans, and any other debt with higher interest rates than your student loans first. The more you spend on interest payments to your credit card company, the less you have to pay off your student loans. Once you pay off your other loans, follow the same logic and focus on your highest-interest student loans first. This is the “avalanche” method of debt payment and will minimize the amount of interest you pay in the long run. The “snowball” method of paying off your smallest loans first can also be a good approach for simplifying your finances, but focusing on the high-interest loans will probably save you the most money.

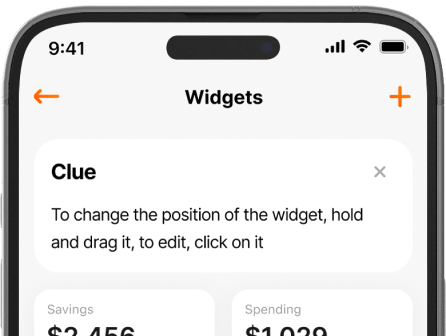

- Get a budget. You should know how much money is coming in, how much is going out, and what you can afford to spend on loan payments. Assuming there’s no early payment penalty, you may want to try to pay off your student loans early to minimize interest payments and get the rest of your financial life moving forward.

- Build an emergency fund. You should save at least 3-6 months of expenses while you’re paying off your loans. This way, if you experience a financial shock of some sort, you’ll be able to avoid missing payments and incurring penalties and can avoid applying for deferment or forbearance.

Finalizing Your Strategy

One positive thing about student loans is how predictable they are. You typically have a payment schedule that you’ll follow until the loan is either paid off or you apply to have it changed. This makes it fairly easy to factor into your long-term financial plan, and the relatively low-interest rates mean that the loan won’t get out of control as long as you continue making at least your required monthly payments.

If you’re overwhelmed by all of your options when it comes to paying off your loans, take a step back and realize that all you need to do is figure out where your loans are, potentially consolidate them if you have several, and choose a good payment plan. If you can afford the ten-year standard payment plan, that’s probably the easiest option. If that would strain your finances, exploring the other plan options shouldn’t take too much time and may be well worth it in the long run. Once you’ve figured out what loans you have and a basic strategy for paying them off, your student loans won’t be a complex part of your finances unless you find yourself having trouble coming up with the money to pay them on time.