You can’t spell “fund” without “fun”! Okay, mutual funds aren’t that entertaining, but saving time and earning money are both pretty nice, right?

If you’re not familiar with this particular financial instrument, the basic idea is quite simple:

- A mutual fund company buys assets like stocks, bonds, real estate, commodities, etc., and puts them in a portfolio, or fund.

- The mutual fund company sells shares of the fund.

- The fund’s value, as well as the value of the company that made it, will rise and fall with the value of its assets. If you’re holding a single share of it, you’re essentially holding a piece of every company, bond, and other asset in the fund.

Being able to buy a whole basket of investments with just one purchase is a pretty powerful investment tool! Not only does it diversify your portfolio, but it makes getting that diversity much easier. Buying all 500 stocks in the S&P 500 by yourself would take a lot of time and around $100,000—but buying a piece of a fund that tracks the S&P 500 can be done with just minutes of your time and as little as a dollar of your money.

So, a company buys assets, then you buy part of the company that has the assets. Pretty simple, right? But wait—what about index funds? ETFs? Active funds? Passive funds? Money market funds? It turns out that there are a lot of variations on the basic mutual fund, and it does matter which ones you choose to invest in.

The big three you’ve probably heard about are active mutual funds, index funds, and exchange-traded funds (ETFs). How are these different, and which ones should you invest in?

Quick Comparison

Active Mutual Funds

An actively managed mutual fund has humans doing research, buying, selling, and trying to beat the market. They charge relatively high fees, and, while some do beat the market, many don’t outperform cheaper passive funds, like index funds and ETFs. Thus, they’ve somewhat fallen out of favor among investors and may not be the best option for getting started.

Index Funds

Index funds are passive, which means they automatically follow a certain list of assets (the S&P 500, for example) rather than having humans make decisions. This means their fees are lower than active mutual funds and their performance is a bit more predictable, but they’ll generally stay close to the market average rather than beating it. They’re easy to use and generally provide good returns over the long term, though some require a high minimum investment.

Exchange-traded Funds (ETFs)

Like index funds, ETFs are passive and low-cost. The biggest difference is how they’re bought and sold: most funds (including active mutual funds and index funds) are purchased through a broker or the company that manages the fund and can only be bought and sold at prices set at the end of the day. ETFs, however, are traded on the stock market and can be bought and sold throughout the day at current prices. This makes them ideal for anyone interested in day trading and/or people looking for funds with low minimum investments.

Active vs Passive: Which is Better?

For the average investor, especially one with long-term goals, passive funds are generally better. They’re more stable and tend to perform better than active funds. However, active funds can still have their place!

Active Funds

Active funds are always changing their investments to try and beat the market, though their success rate is generally mixed. They can be effective at preventing losses during down markets and perform better in certain categories, but, on average, many passive index funds have generally outperformed active mutual funds over longer periods. Active funds are also not very predictable since the fund manager can theoretically shake up the portfolio any time they want to.

Passive Funds

Since index funds and most ETFs (some ETFs are active) are trying to match the market, they’re easier to predict. The indexes they follow tend not to change dramatically, so you often have a good idea of what your investment will contain in ten years. They don’t have much leeway to adapt in the short term when the market is down, but over the long term, they tend to recover and go back to beating active funds’ performance.

How to Buy and Sell Mutual Funds, Index Funds, and ETFs

Mutual/Index Funds

There are two main ways to buy a mutual fund (including index funds and various other mutual fund flavors):

- Make an account with the company managing the fund and buy the fund directly from them

- Find a brokerage selling the fund you want and buy it there

Unlike stocks, funds aren’t necessarily offered by every stockbroker, and they may have minimum investment requirements of up to several thousand dollars. Before you buy, make sure you know the general goals and composition of the fund, and check what the fees are relative to other funds on the market.

These funds’ prices are set to the net value of their underlying assets once per day, at 4 PM, and that price applies for the next 24 hours. This doesn’t have much impact on long-term buyers, but if you’re looking to do intraday trades, consider ETFs instead.

Exchange-traded Funds

If you know how to buy a stock, you know how to buy ETFs! As the name implies, you can trade them on stock exchanges. Simply create an account with a brokerage, find the ETF you want to buy, and buy it!

Unlike other funds, the value of an ETF changes throughout the trading day, so you can trade intra-day if you want to.

How You Make Money

Pretty much every type of fund gets you returns in the same ways:

- Distributions (money the fund pays you directly) from the profits that the fund makes off the stock, including dividends, interest, and capital gains from selling at a profit

- Capital gains, which is when you sell off the fund for more than you paid for it

Distributions are essentially payments from the mutual fund to the shareholders. You don’t directly own the assets in the fund, but the fund still has to give you the profits as if you did. If a stock pays dividends or a bond pays interest, you get a share in that. Sometimes funds also sell off some of their assets, and if they make a profit, you also get part of the profit.

Capital gains are fairly self-explanatory—you sell at a higher price than you bought, and you make a profit!

Cost/Fees

Here’s where things get quite different! Active mutual funds charge relatively high fees, while index funds and ETFs tend to be quite a bit lower.

Expense Ratios

The expense ratio is a percentage of all assets under management that a fund deducts every year to pay for trading fees, salaries, and other overhead costs. These apply to all funds, including active mutual funds, index funds, and ETFs.

Thus, if you have a total of $1,000 invested in an active mutual fund with a 1% expense ratio, you’ll pay $10 for a year. As you invest more and your money yields returns, that 1% starts to add up, since it’s taken from your total investment.

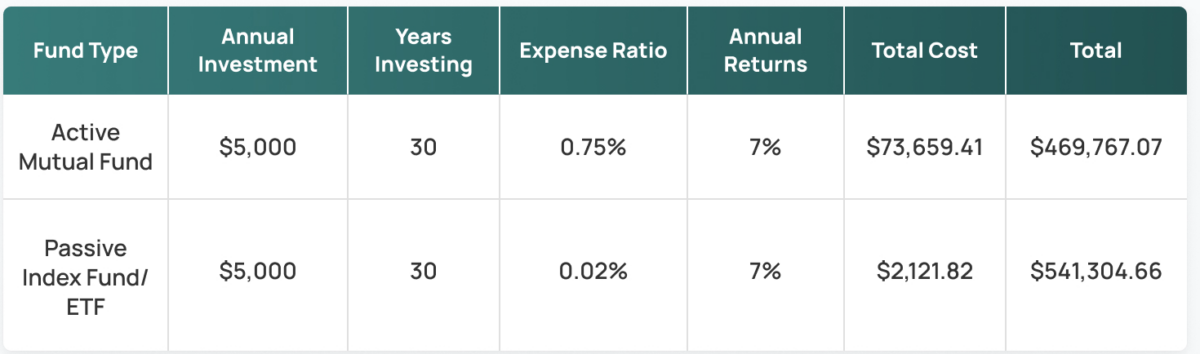

Let’s compare what you’d end up paying if you invested $5,000 a year for 30 years in an active mutual fund vs a passive index fund/ETF (since index funds and ETFs have very similar expense ratios).

As you can see, even a fairly small percentage can add up to a very significant chunk of money over time! Since active funds don’t consistently beat passive ones, paying the high fees is something investors should consider carefully.

Loads

You might see that some funds have “loads.” There are fees the investor pays when buying the fund, and they go to the brokerage or advisor that sold the fund to you. These can be charged when you buy the fund, when you sell it, or on your fund’s returns over the entire time you own the fund.

These fees can easily be over 5%, so avoiding them whenever possible is a good idea! There are plenty of no-load funds out there that are easily as good as funds with loads, so unless you have a good reason, a load fund probably isn’t worth it. Luckily, index funds and ETFs don’t have loads, so you only need to watch out for them on mutual funds.

Transaction Fees

Many fund managers and brokerages charge fees for buying and/or selling shares of mutual funds, index funds, and ETFs, and if you’re buying even on, say, a monthly basis, those fees can add up over time! Different brokers have different fees, but it’s not uncommon for them to exceed $7.00.

However, an increasing number of companies are now offering no-fee trades, so avoiding this expense can be as easy as simply finding one of those.

Investment Strategies

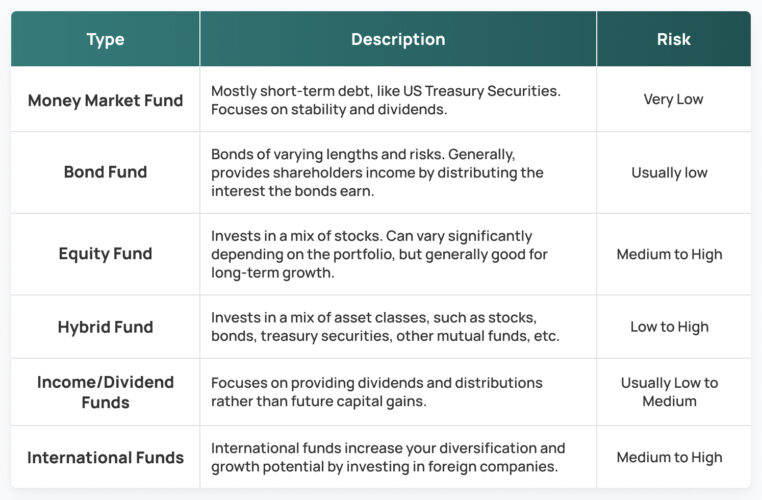

Every fund is created with certain goals in mind. A lot of index funds track the S&P 500, for example, since those large companies are likely to be stable and perform well in the long term. Some funds, though, choose to focus on a certain sector, like energy or technology. Others might target certain types of investments, like US Treasury securities, gold, or companies with growth potential.

This can get complex very quickly, but, as a rule of thumb, it’s a good idea to invest most heavily in funds that hold a wide variety of high-quality companies. For index funds/ETFs, that means the S&P 500, the Dow Jones Industrial Average, the Nasdaq Composite, the Wilshire 5000, and others. A mix of these, or even just one, will likely be enough to generate good returns.

If you’re looking to get a bit more hands-on, however, it might be a good idea to look for funds that suit your investing goals. Younger investors, for example, might want to find a fund that targets more aggressive growth, with the higher risk being balanced out by the long time horizon the fund has to recover losses. Or you might be looking for a fund that pays regular dividends, or a fund that invests in a certain sector.

Even if you don’t have special goals, however, you could consider adding a few funds that don’t just target large-cap U.S companies, just to diversify. Depending on your situation, you may want to consider adding some small or mid-cap funds, foreign stock funds, bond funds, et cetera.

There are a lot of different investment strategies, but the ones below are some of the most common. You’ll often find this described as active mutual funds, but you can usually find index funds and ETFs that follow the same strategies.

Which Type of Fund Should I Invest In?

Funds are meant to make investing easier, so don’t overcomplicate it too much! For most people with long-term investment goals, investing regularly in a few index funds is probably all you need. The simplest possible strategy is to regularly invest in an index fund that tracks the S&P 500. Over time, you can add some diversity and get some other funds that can help you reach your investment goals. Remember to watch out for transaction fees and cost ratios!

If you want something more specific, like an aggressive investment strategy or a portfolio that provides consistent income through dividends, you’ll have to do a bit more research, but there are funds tailored to many different needs! You don’t have to be an expert investor—just find a selection of funds and see which ones fit your goals for the lowest cost.

In general, it’s best to steer away from active mutual funds unless you have a specific strategy in mind. Passive ETFs and index funds, however, are essentially interchangeable in terms of cost and risk, so either one can be a good bet! The important thing is to find funds that are well-diversified and easy for you to invest in regularly as you build up savings, and that’s something you should be able to get from nearly any financial institution that sells them.

How Finmatex Can Help

With Finmatex, you’ll have all your cash, bank, and investment accounts all in one place. It’s extremely helpful as it makes all transactions transparent and you get that desired control over your financial life. On top of that, we offer a 1-week free trial for new users. Give it a try, here is the link for Android and iOS.