Nothing kills a vacation like money worries. Literally, the last thing you want to do on a long-awaited trip is to count every penny. What you want is to be wise about your money, and Finmatex team is here to help you with that. Below we share some practical money-saving tips on how to have a stressless vacation within your means.

Set Your Total Vacation Budget

This is something you might want to do before you even begin scouring the internet for tickets and lodging. No matter how boring and daunting it may seem — it’s absolutely essential. By realistically and carefully estimating how much money you own and, more importantly, are ready to spend in a week or two of traveling without emptying out your bank account, you can plan a feasible and financially worry-free trip.

First off, after you’ve chosen your travel destination, do a little research to find out the average prices for the 4 major expense categories: transport, accommodation, meals, and activities. This will give you a ballpark cost of your trip and help you spot cheaper deals on airfare and lodging. For example, if you know that a flight to, say, Berlin usually hovers around $300, and you see it on sale for $200, you won’t miss your chance to snag this bargain.

Secondly, define your priorities. For example, families with kids value comfort and tend to choose quiet, children-friendly hotels with an all-you-can-eat buffet and a playground but don’t splurge on tours and eating out. Whereas young people prefer to stay in a hostel closer to the city center to take in all the sights and get a local clubbing experience. So when budgeting for a vacation, focus on what’s most important to you and determine possible money-saving opportunities.

Determine a Daily Budget

Once you drafted your total vacation budget, set a daily spending limit. This will you save from the headache of constantly calculating how much money is left and how much you still can spend. Knowing your limit, you will also be able to avoid the risk of splurging on something pricey at the beginning of the trip and spending the rest of your vacation on a shoestring. Deciding on a daily limit, make sure you’re being thrifty but not stingy. Leave some wiggle room in your budget for extra experiences or spontaneous purchases.

Bring Along a Prepaid Card

Now, let’s talk packing. A prepaid card is definitely one of the things you might want to put on your checklist for a budget-friendly trip. This is an effective and simple tool to control your expenses when traveling. You can get a prepaid card from a store, bank, or credit union and load it up with the money you’re planning to spend on a trip up to the maximum amount allowed by the issuer — the limits range from $1000 up to $100,000 depending on the card you choose. Since unlike credit cards and some debit cards, prepaid cards don’t offer overdrafts, you will be able to rely on only the money you have loaded and not a penny more. This will help you spend money wisely and avoid getting into debt you have to pay off when you get back.

A prepaid card is also a much safer alternative to cash, debit, and credit cards. If it gets lost or stolen, thieves won’t be able to access your bank account or credit cards, — only the cash loaded onto the card. Besides, some networks that offer prepaid cards, such as Visa and Mastercard, provide a zero liability policy under which you as the cardholder won’t be responsible for “unauthorized charges”.

Follow Money-Saving Travel Tricks

And here are some proven hacks for saving money on vacation.

While on Vacation, Do as the Locals Do

When choosing a restaurant, bar, or store, don’t seek advice from travel agents, guides, and hotel staff. Those who deal with tourists daily in their job would probably go for safer bets and recommend places that are overcrowded with tourists and severely overpriced.

Talk to locals. They always know best where to eat, drink, and shop at a reasonable price, not inflated specifically for foreigners, and will point you to lesser-known, cheaper spots with good food, a pleasant atmosphere, and local flavor. Only by going off the beaten track and seeing through the eyes of locals you can get a truly authentic experience, and avoid huge overspending.

Cook Some of Your Meals

Trying national cuisine is a big part of traveling. A trip to Paris doesn’t count if you haven’t tried croissants. But eating out for every meal can put a pretty big dent in your vacation budget.

To save some money, look for accommodations that offer kitchenettes. You will get groceries from a local market or shop and whip something up instead of splurging on food in a restaurant. Depending on the appliances the place offers, it can be a quick breakfast, a simple snack, or even a full dinner for the whole family.

Don’t Splurge on Souvenirs

Buying souvenirs for your loved ones when on vacation is a nice but rather costly tradition. It usually requires a lot of time and effort. First, you need to make a list of those who “deserve” to get a little something from your trip, then decide on the price of the gifts, and finally find the perfect souvenirs for everyone. Eventually, a coffee mug here, a T-shirt there, and boom! You’ve burned a hole in your pocket and got overweight luggage.

You definitely shouldn’t skimp on that tradition if you really like making your friends and family happy. But if it feels like a burden to you, consider cutting back on souvenirs a bit. Buy gifts only for your closest ones, not for all of your colleagues and neighbors. It might also be a good idea to get something that you can enjoy together with your friends and family after the trip like a bottle of local wine, some traditional foods, or a board game.

Track Your Spending with an App

This is probably the most important vacation money-saving tip of all. Monitoring your expenses is always a good idea, not only on vacation. It can give you a clearer picture of where exactly your money goes and see if you can afford some splurging out or need to curb unnecessary spending for a while.

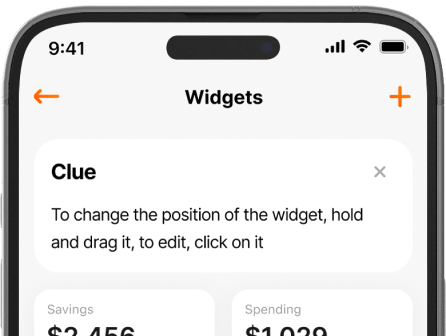

And with Finmatex app, you don’t need to keep a spreadsheet or notes on your phone to do so. You can keep all your accounts in one place and track every dollar that comes in and goes out automatically. Categorize your transactions, create a budget, set financial goals, get detailed reports, and more with only one app! Start your 1-week free trial now and take full control over your money! Download Finmatex app is available on Android and iOS.